The Vertical Farming Market size was valued at USD 8 Billion in 2025 and the total Vertical Farming revenue is expected to grow at a CAGR of 25.7% from 2025 to 2032, reaching nearly USD 39.70 Billion by 2032. The Vertical Farming Market is experiencing growth driven by urbanization, shrinking arable land, and rising demand for sustainable, pesticide-free produce. Large-scale facilities are demonstrating the potential of this approach: for example, a multi-story farm in Dubai spanning 330,000 sq ft produces over 6,000 lb of leafy greens daily, totaling more than 1 million kg annually. Companies such as Plenty Unlimited have raised significant investments, including hundreds of millions of dollars in funding rounds, reflecting strong INVESTMENT in the sector. Global investment in vertical farming continues to rise, with venture capital and corporate investors injecting hundreds of millions of dollars into innovative indoor farms between 2022 and 2025. Technological advancements including hydroponics, aeroponics, energy-efficient LED lighting, and AI-driven climate control enable yield improvements of 10× to 400× compared to traditional farming while reducing water usage by up to 95%. Governments are supporting the industry through incentives, grants, and training programs, helping to scale hydroponic and vertical greenhouse initiatives. These developments illustrate how vertical farming is transitioning from niche pilot projects to commercially viable, high-yield operations, positioning it as a crucial solution for global food security and sustainable urban agriculture.To know about the Research Methodology :- Request Free Sample Report

Vertical Farming Market: Key Trends

Increasing Population and Declining Arable Land Boost Vertical Farming Market Growth The Vertical Farming Market is gaining rapid traction due to the rising global population and the declining availability of cultivable land. According to the United Nations, the world population surpassed 8 billion in 2023, intensifying the pressure on global food production. Traditional agriculture faces multiple challenges, including soil degradation, unpredictable weather, and water scarcity, particularly in regions such as India, China, and the Middle East. As urbanization expands, arable land continues to shrink, urging the adoption of controlled-environment agriculture (CEA) solutions. Vertical farming enables high-yield crop production in vertically stacked layers using hydroponic, aeroponic, and aquaponic systems, significantly increasing land-use efficiency. For instance, AeroFarms (U.S.) and Infarm (Germany) have developed fully automated facilities that optimize space and minimize pesticide use. This approach ensures year-round cultivation while cutting water usage by up to 95% compared to traditional farming.Also, the proximity of vertical farms to urban centers reduces transportation costs and carbon emissions, supporting global sustainability goals. Thus, the growing population, combined with limited farmland, is accelerating the global vertical farming industry growth, making it a critical component of the future food supply chain.

Global Vertical Farming Market Dynamics:

Limited Crop Variety Restrains Vertical Farming Market growth A key challenge hampering the Vertical Farming Market Growth is the limited crop variety that can be efficiently cultivated within vertical systems. While vertical farming excels in producing leafy greens, herbs, and microgreens, it struggles to accommodate crops such as grains, fruits, and root vegetables that require extensive root zones, longer maturation cycles, and variable environmental conditions. These limitations stem from the high operational costs of maintaining customized temperature, humidity, and light intensity for each crop type. Additionally, energy-intensive LED lighting systems and sophisticated climate control setups increase production costs, making certain crops economically unviable. For example, Bowery Farming and Plenty Unlimited are exploring advanced LED spectrum optimization and AI-based growth models to expand their crop range, but scalability remains challenging. Furthermore, consumer demand for diverse food options pushes producers to seek hybrid models combining vertical and greenhouse farming. Despite ongoing innovation, the industry must overcome technological and biological constraints to expand beyond high-margin greens. Thus, while vertical farming offers sustainability and efficiency, the restricted crop portfolio remains a major barrier to its broader global adoption. Technological Innovation Creates Lucrative Growth Opportunities to the Vertical Farming Market Rapid technological innovation presents significant opportunities for the Global Vertical Farming Market. Emerging technologies such as automation, artificial intelligence (AI), Internet of Things (IoT), and robotics are revolutionizing modern agriculture by enhancing efficiency, yield, and sustainability. AI-powered sensors monitor temperature, light, and nutrient levels in real time, enabling farmers to optimize growth conditions and resource use. For instance, CropOne Holdings employs IoT-driven climate control systems to reduce water consumption by up to 95%, while Sky Greens (Singapore) integrates hydraulic water-driven towers to minimize energy consumption. The integration of renewable energy sources such as solar panels and wind energy further reduces operational costs and carbon footprints.Also, cloud-based analytics and data-driven farming software help predict crop cycles and market demand, improving profitability. Governments in regions Such as the UAE, Japan, and the Netherlands are supporting vertical farming through agritech investments and smart city initiatives. As these innovations become more affordable and scalable, vertical farming is expected to evolve into a mainstream urban agriculture solution, addressing global food security, sustainability, and climate resilience goals. Vertical Farming Market – Key Technologies and Components

Technology/Component Description Controlled Environment Agriculture (CEA) Involves creating a fully controlled indoor farming environment that regulates temperature, humidity, lighting, and nutrient supply to ensure optimal plant growth and year-round cultivation. Smart Sensors Equipped with advanced IoT-enabled sensors to monitor environmental factors such as temperature, humidity, CO₂ levels, lighting, nutrient concentration, and pH levels in real time for precision farming. Air Control Systems Manages airflow, humidity, and CO₂ enrichment to optimize plant respiration and growth, ensuring consistent air quality inside vertical farms. Internet of Things (IoT) Integrates sensors, cloud computing, and automation for data-driven monitoring and control of farming conditions, enhancing productivity and sustainability. CO₂ Enrichment Techniques Uses CO₂ injection, misting, or compressed gas systems to enrich the air within growing chambers, promoting photosynthesis and increasing crop yield. Vertical Farming Market: Segment Analysis

Based on Structure, the Vertical Farming market is segmented into Building based structure Container based structure, The container-based segment dominated the structure segment of the vertical farming market in 2025. Due to its flexibility, cost-effectiveness, and scalability. Container-based vertical farms are built using repurposed shipping containers equipped with hydroponic or aeroponic systems, LED grow lights, and climate control technologies, enabling efficient crop production in compact spaces. These systems are ideal for urban environments, where space is limited and real estate costs are high. Unlike building-based structures, container farms easily transported, deployed, and expanded, making them attractive for startups, research facilities, and small-scale producers. The lower initial investment and modular design allow for rapid setup and reduced operational risk. Also, container-based farms ensure year-round cultivation and precise control of growing conditions, leading to higher yields and consistent quality. Companies like Freight Farms (U.S.) and Grow Pod Solutions are leveraging container farming for local, pesticide-free food production, driving its dominance in the structure segment and supporting sustainable urban agriculture growth.Based on Type, the Vertical Farming market is segmented Hydroponics, Aeroponics, and Aquaponics. Hydroponic farming systems use nutrient-rich water instead of soil, consuming up to 90% less water than conventional agriculture while producing higher yields. This method supports sustainable agriculture by minimizing waste, eliminating soil-borne diseases, and reducing carbon emissions. The rising demand for safe, pesticide-free, and healthy food in urban areas is accelerating the adoption of hydroponic vertical farming systems worldwide.

Meanwhile, the aeroponics segment is expected to gain significant traction due to its innovative use of air and mist to deliver nutrients directly to plant roots. This technique enhances oxygen availability, leading to faster growth rates and richer flavors without the need for chemical fertilizers or pesticides. These advantages are driving investments in smart vertical farms across countries like the U.S., Japan, Singapore, and the Netherlands, supporting the global shift toward sustainable urban agriculture and controlled-environment farming solutions.

Vertical Farming Market: Regional Analysis

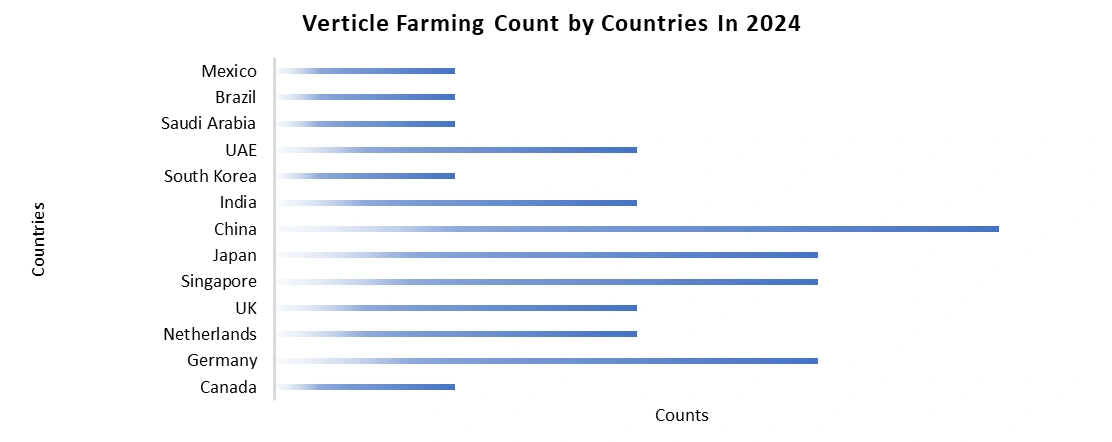

North America dominated the Vertical Farming Market in Year 2025, with the U.S. and Canada hosting major players like AeroFarms and Plenty, supported by robust investments and urban retail integration. Europe, particularly Germany, the Netherlands, and the UK, emphasizes sustainable systems and advanced automation, with companies like Infarm pioneering modular indoor farms. Asia-Pacific is emerging as the fastest-growing region, fueled by government initiatives in Singapore, Japan, China, and India, where projects like Sky Greens and Urban Isaan enhance urban food production. The Middle East, especially UAE and Saudi Arabia, invests heavily in vertical farming to improve food security, exemplified by projects like Crop One’s ECO-1 and Pure Harvest’s desert farms. Meanwhile, South America, led by Brazil and Mexico, is in an early adoption stage, focusing on small-scale and container-based farms to reduce food imports and enhance urban supply chains.Vertical Farming Market Competitive Landscape:

The global Vertical Farming Market is moderately fragmented, with leading players like AeroFarms, Bowery Farming, Infarm, and Jones Food Company driving innovation through automation, IoT, and smart climate-control systems. Companies focus on technology differentiation, strategic partnerships, and geographic expansion to gain a competitive edge. Key strategies include AI-powered cultivation, robotics integration, and energy-efficient LED lighting to enhance yield and reduce operational costs. Product diversification into leafy greens, berries, herbs, and ornamental crops enables market expansion, while sustainability and traceability initiatives strengthen brand positioning. Regional dynamics show North America leading in revenue and technological adoption, while Asia-Pacific particularly India, China, and Japan experience rapid growth due to urbanization, limited arable land, and government incentives. Challenges such as high capital investment, energy costs, and crop-mix limitations persist, creating opportunities for innovative solutions and hardware providers. Stakeholders targeting automation hardware, sensors, and climate-control systems can leverage growth in this evolving market.

Vertical Farming Market Recent Development

In March 2024, Vertical Future (VF) partnered with the World Green Economy Organisation (WGEO) to promote joint sustainability goals. VF, as a technology-driven leader in resource-efficient crop production, aligns with WGEO’s mission of advancing a green economy as the most effective path toward global prosperity and environmental safety. In January 2023, Siemens collaborated with 80 Acres to provide essential technologies supporting 80 Acres’ farming operations through the Infinite Acres Loop solution. Leveraging artificial intelligence and machine learning, Siemens is developing an application designed to optimize crop management by detecting anomalies and preventing adverse conditions in the fields. In June 2023, Bedrock and Vertical Harvest unveiled plans for Vertical Harvest Detroit, a 60,000-square-foot facility located in Detroit’s Milwaukee Junction neighborhood. The project will include a 205,000-square-foot growing canopy utilizing hydroponic and vertical farming techniques, aiming to produce 2.2 million pounds of vegetables annually, such as lettuce, leafy greens, and herbs. In December 2023, Oishii launched its latest product, the Rubi Tomato, at select Whole Foods locations across the US. These tomatoes, originating from a Japanese “fruit tomato” variety, are grown in Oishii’s indoor vertical farms near New York City. This launch represents Oishii’s third consumer market offering and its first product beyond traditional tomatoes. Moreover, the company is expanding its product availability to the Northeastern US for the first time.Vertical Farming Market Ecosystem:

Vertical Farming Market Scope: Inquire before buying

Vertical Farming Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 8 Bn. Forecast Period 2026 to 2032 CAGR: 25.7% Market Size in 2032: USD 39.70 Bn. Segments Covered: by Type Hydroponic Aeroponic Aquaponic by Structure Building-Based Vertical Farms Shipping-Container Vertical Farms by Component Lighting System Irrigation and Fertigation System Climate Control Sensors Others Vertical Farming Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Vertical Farming Market, Key Players

1. Eden Green Technology 2. 80 Acres Farms 3. BrightFarms 4. CubicFarm Systems 5. Dream Harvest Farms 6. Farm.One 7. Freight Farms 8. GoodLeaf Farms 9. Gotham Greens 10. GP Solutions 11. Hydrofarm Holdings 12. Little Leaf Farms 13. Local Bounti 14. Oishii 15. Revol Greens 16. Smallhold 17. Soli Organic 18. Square Roots 19. Vertical Harvest 20. Vertical Roots 21. Village Farms International.Frequently Asked Questions:

1] What segments are covered in the Global Vertical Farming Market report? Ans. The segments covered in the Vertical Farming Market report are based on, Growth Mechanism, Structure, Application and Regions. 2] Which region is expected to hold the highest share of the Global Vertical Farming Market? Ans. The North America region is expected to hold the highest share of the Vertical Farming Market. 3] What is the market size of the Global Vertical Farming Market by 2032? Ans. The market size of the Vertical Farming Market by 2032 is expected to reach USD 39.70 Bn. 4] What was the Global Vertical Farming Market size in 2024? Ans: The Global Vertical Farming Market size was USD 8 Billion in 2024. 5] Key players in the Vertical Farming Market. Ans. AeroFarms (United States), Plenty (United States), Bowery Farming (United States, BrightFarms (United States), Gotham Greens (United States) and Lufa Farms (Canada).

1. Vertical Farming Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Vertical Farming Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Product Segment 2.2.3. End-User Segment 2.2.4. Revenue Details in 2025 2.2.5. Market Share (%) 2.2.6. Profit Margin(%) 2.2.7. Headquarter 2.2.8. Technologies Advancements 2.2.9. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Vertical Farming Market: Dynamics 3.1. Vertical Farming Market Trends 3.1.1. Role of Automation and Robotics in Livestock Farming 3.1.2. Emergence of Smart Sensors and Monitoring Devices 3.1.3. Advances in Real-Time Data Analytics for Vertical Farming 3.2. Vertical Farming Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Vertical Farming Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 4.1. Vertical Farming Market Size and Forecast, By Type (2025-2032) 4.1.1. Hydroponics 4.1.2. Aeroponics 4.1.3. Aquaponics 4.2. Vertical Farming Market Size and Forecast, By Structure (2025-2032) 4.2.1. Building-Based Vertical Farms 4.2.2. Shipping-Container Vertical Farms 4.3. Vertical Farming Market Size and Forecast, By Component (2025-2032) 4.3.1. Lighting System 4.3.2. Irrigation and Fertigation System 4.3.3. Climate Control 4.3.4. Sensors 4.3.5. Others 4.4. Vertical Farming Market Size and Forecast, By Region (2025-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 5.1. North America Vertical Farming Market Size and Forecast, By Type (2025-2032) 5.2. North America Vertical Farming Market Size and Forecast, By Structure (2025-2032) 5.3. North America Vertical Farming Market Size and Forecast, By Component (2025-2032) 5.4. North America Vertical Farming Market Size and Forecast, by Country (2025-2032) 5.4.1. United States 5.4.1.1. United States Vertical Farming Market Size and Forecast, By Type (2025-2032) 5.4.1.2. United States Vertical Farming Market Size and Forecast, By Structure (2025- 5.4.1.2.1. 5.4.1.3. United States Vertical Farming Market Size and Forecast, By Component (2025-2032) 5.4.1.3.1. Visualization 5.4.2. Canada 5.4.2.1. Canada Vertical Farming Market Size and Forecast, By Type (2025-2032) 5.4.2.2. Canada Vertical Farming Market Size and Forecast, By Structure (2025-2032) 5.4.2.3. Canada Vertical Farming Market Size and Forecast, By Component (2025-2032) 5.4.3. Mexico 5.4.3.1. Mexico Vertical Farming Market Size and Forecast, By Type (2025-2032) 5.4.3.2. Mexico Vertical Farming Market Size and Forecast, By Structure (2025-2032) 5.4.3.3. Mexico Vertical Farming Market Size and Forecast, By Component (2025-2032) 6. Europe Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 6.1. Europe Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.2. Europe Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.3. Europe Vertical Farming Market Size and Forecast, By Component (2025-2032) 6.4. Europe Vertical Farming Market Size and Forecast, by Country (2025-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.4.1.2. United Kingdom Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.4.1.3. United Kingdom Vertical Farming Market Size and Forecast, By Component (2025-2032) 6.4.2. France 6.4.2.1. France Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.4.2.2. France Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.4.2.3. France Vertical Farming Market Size and Forecast, By Component (2025-2032) 6.4.3. Germany 6.4.3.1. Germany Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.4.3.2. Germany Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.4.3.3. Germany Vertical Farming Market Size and Forecast, By Component (2025-2032) 6.4.4. Italy 6.4.4.1. Italy Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.4.4.2. Italy Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.4.4.3. Italy Vertical Farming Market Size and Forecast, By Component (2025-2032) 6.4.5. Spain 6.4.5.1. Spain Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.4.5.2. Spain Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.4.5.3. Spain Vertical Farming Market Size and Forecast, By Component (2025-2032) 6.4.6. Sweden 6.4.6.1. Sweden Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.4.6.2. Sweden Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.4.6.3. Sweden Vertical Farming Market Size and Forecast, By Component (2025-2032) 6.4.7. Russia 6.4.7.1. Russia Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.4.7.2. Russia Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.4.7.3. Russia Vertical Farming Market Size and Forecast, By Component (2025-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Vertical Farming Market Size and Forecast, By Type (2025-2032) 6.4.8.2. Rest of Europe Vertical Farming Market Size and Forecast, By Structure (2025-2032) 6.4.8.3. Rest of Europe Vertical Farming Market Size and Forecast, By Component (2025-2032) 7. Asia Pacific Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 7.1. Asia Pacific Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.2. Asia Pacific Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.3. Asia Pacific Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4. Asia Pacific Vertical Farming Market Size and Forecast, by Country (2025-2032) 7.4.1. China 7.4.1.1. China Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.1.2. China Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.1.3. China Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.2. S Korea 7.4.2.1. S Korea Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.2.2. S Korea Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.2.3. S Korea Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.3. Japan 7.4.3.1. Japan Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.3.2. Japan Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.3.3. Japan Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.4. India 7.4.4.1. India Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.4.2. India Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.4.3. India Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.5. Australia 7.4.5.1. Australia Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.5.2. Australia Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.5.3. Australia Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.6.2. Indonesia Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.6.3. Indonesia Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.7.2. Malaysia Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.7.3. Malaysia Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.8. Philippines 7.4.8.1. Philippines Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.8.2. Philippines Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.8.3. Philippines Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.9. Thailand 7.4.9.1. Thailand Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.9.2. Thailand Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.9.3. Thailand Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.10.2. Vietnam Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.10.3. Vietnam Vertical Farming Market Size and Forecast, By Component (2025-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Vertical Farming Market Size and Forecast, By Type (2025-2032) 7.4.11.2. Rest of Asia Pacific Vertical Farming Market Size and Forecast, By Structure (2025-2032) 7.4.11.3. Rest of Asia Pacific Vertical Farming Market Size and Forecast, By Component (2025-2032) 8. Middle East and Africa Vertical Farming Market Size and Forecast (by Value in USD Billion) (2025-2032 8.1. Middle East and Africa Vertical Farming Market Size and Forecast, By Type (2025-2032) 8.2. Middle East and Africa Vertical Farming Market Size and Forecast, By Structure (2025-2032) 8.3. Middle East and Africa Vertical Farming Market Size and Forecast, By Component (2025-2032) 8.4. Middle East and Africa Vertical Farming Market Size and Forecast, by Country (2025-2032) 8.4.1. South Africa 8.4.1.1. South Africa Vertical Farming Market Size and Forecast, By Type (2025-2032) 8.4.1.2. South Africa Vertical Farming Market Size and Forecast, By Structure (2025-2032) 8.4.1.3. South Africa Vertical Farming Market Size and Forecast, By Component (2025-2032) 8.4.2. GCC 8.4.2.1. GCC Vertical Farming Market Size and Forecast, By Type (2025-2032) 8.4.2.2. GCC Vertical Farming Market Size and Forecast, By Structure (2025-2032) 8.4.2.3. GCC Vertical Farming Market Size and Forecast, By Component (2025-2032) 8.4.3. Egypt 8.4.3.1. Egypt Vertical Farming Market Size and Forecast, By Type (2025-2032) 8.4.3.2. Egypt Vertical Farming Market Size and Forecast, By Structure (2025-2032) 8.4.3.3. Egypt Vertical Farming Market Size and Forecast, By Component (2025-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Vertical Farming Market Size and Forecast, By Type (2025-2032) 8.4.4.2. Nigeria Vertical Farming Market Size and Forecast, By Structure (2025-2032) 8.4.4.3. Nigeria Vertical Farming Market Size and Forecast, By Component (2025-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Vertical Farming Market Size and Forecast, By Type (2025-2032) 8.4.5.2. Rest of ME&A Vertical Farming Market Size and Forecast, By Structure (2025-2032) 8.4.5.3. Rest of ME&A Vertical Farming Market Size and Forecast, By Component (2025-2032) 9. South America Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032 9.1. South America Vertical Farming Market Size and Forecast, By Type (2025-2032) 9.2. South America Vertical Farming Market Size and Forecast, By Structure (2025-2032) 9.3. South America Vertical Farming Market Size and Forecast, By Component (2025-2032) 9.4. South America Vertical Farming Market Size and Forecast, by Country (2025-2032) 9.4.1. Brazil 9.4.1.1. Brazil Vertical Farming Market Size and Forecast, By Type (2025-2032) 9.4.1.2. Brazil Vertical Farming Market Size and Forecast, By Structure (2025-2032) 9.4.1.3. Brazil Vertical Farming Market Size and Forecast, By Component (2025-2032) 9.4.2. Argentina 9.4.2.1. Argentina Vertical Farming Market Size and Forecast, By Type (2025-2032) 9.4.2.2. Argentina Vertical Farming Market Size and Forecast, By Structure (2025-2032) 9.4.2.3. Argentina Vertical Farming Market Size and Forecast, By Component (2025-2032) 9.4.3. Colombia 9.4.3.1. Colombia Vertical Farming Market Size and Forecast, By Type (2025-2032) 9.4.3.2. Colombia Vertical Farming Market Size and Forecast, By Structure (2025-2032) 9.4.3.3. Colombia Vertical Farming Market Size and Forecast, By Component (2025-2032) 9.4.4. Chile 9.4.4.1. Chile Vertical Farming Market Size and Forecast, By Type (2025-2032) 9.4.4.2. Chile Vertical Farming Market Size and Forecast, By Structure (2025-2032) 9.4.4.3. Chile Vertical Farming Market Size and Forecast, By Component (2025-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Vertical Farming Market Size and Forecast, By Type (2025-2032) 9.4.5.2. Rest Of South America Vertical Farming Market Size and Forecast, By Structure (2025-2032) 9.4.5.3. Rest Of South America Vertical Farming Market Size and Forecast, By Component (2025-2032) 10. Company Profile: Key Players 10.1. Eden Green Technology 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. 80 Acres Farms 10.3. BrightFarms 10.4. CubicFarm Systems 10.5. Dream Harvest Farms 10.6. Farm.One 10.7. Freight Farms 10.8. GoodLeaf Farms 10.9. Gotham Greens 10.10. GP Solutions 10.11. Hydrofarm Holdings 10.12. Little Leaf Farms 10.13. Local Bounti 10.14. Oishii 10.15. Revol Greens 10.16. Smallhold 10.17. Soli Organic 10.18. Square Roots 10.19. Vertical Harvest 10.20. Vertical Roots 10.21. Village Farms International 11. Key Findings 12. Industry Recommendations 13. Vertical Farming Market: Research Methodology